Facebook’s poke feature now includes streaks, similar to Snapchat’s daily streaks

The classic Poke returns on Facebook with streak mechanics, encouraging daily interactions via a profile button.

Google Pay is a popular payment app in India, and now it's set to become even more user-friendly with some exciting new features. Let's take a look at the upcoming updates that were announced at the "Google for India" event.

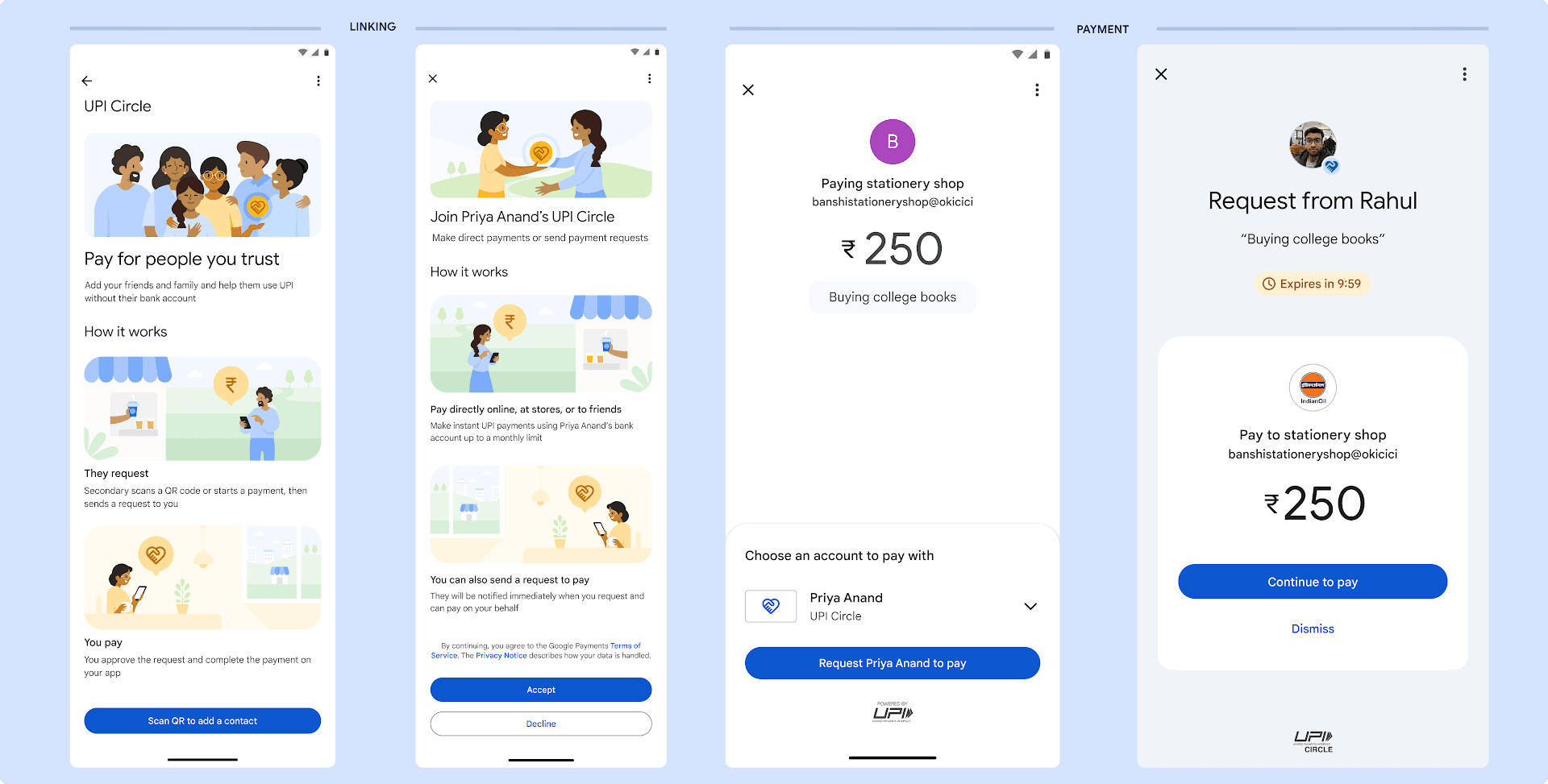

Google is introducing the UPI Circle feature for both Android and iOS platforms. To check if this feature is available for you, update your Google Pay app. Once you have access to UPI Circle, follow these steps:

UPI Circle is designed to help those who may not have a bank account or find it difficult to manage digital payments. According to Google, this feature involves two key roles:

In conclusion, the new features coming to Google Pay in India will enhance the payment experience for users and provide them with more options for managing their finances.

Whether you want to add members through UPI Circle, get loan-related assistance through the Support Guide, or explore gold loans and personal loans, Google Pay has you covered.

Stay tuned for the release of these features and enjoy a seamless payment experience with Google Pay.